Articles

Then you might be interested in to experience at any of one’s court sweepstake casinos. We can strongly recommend individuals common websites such as Chumba (most popular societal gambling establishment in the usa). Yes, interest made from a high-produce bank account is normally felt taxable earnings and ought to be advertised once you document your own taxes. For those who secure at the very least $ten in the demand for a calendar year, your own financial will topic your Mode 1099-INT, and therefore details the level of desire you gotten. The degree of interest you can earn for the $ten,100 inside a leading-produce family savings will depend on the new account’s APY and exactly how often focus try compounded. Including, should your APY is actually 5.25% for the whole seasons and you can attention try compounded every day, you’ll earn regarding the $525 inside the annually.

Global features

It carefully discuss the fresh terms and conditions and evaluate its worth to other gambling establishment advertisements. Modern jackpot ports features the lowest RTP and you will highest volatility, so are not typically the best choice to own to try out via your extra cash. Nonetheless they create offer a way to winnings an existence-modifying sum of money. The new maximum dollars winnings can sometimes be on the seven-shape assortment, therefore modern jackpot slots is going to be a great choice inspite of the odds not being on your side. Particular sites render particular gambling establishment campaigns so you can professionals deemed while the high rollers.

Most recent Marcus from the Goldman Sachs Cd Cost

AARP worked in order that those people who are gathering Social Security professionals to possess retirement, impairment otherwise Extra Protection Earnings (SSI) might possibly be eligible for the new stimuli money. AARP and successfully fought to ensure one to low-earnings Societal Shelter receiver get the full $1,200 look at, maybe not $600 as the to start with recommended. Within the a good letter taken to Congress to your February 17, AARP questioned lawmakers so you can provide payments directly to People in america included in people stimulus bundles.

Deposit accounts provide zero monthly costs, extra interest levels, and you may savings on the financing. Additionally you get a good 75% advantages incentive on the qualified charge card purchases, superior offers, and you will a good dos% write off to your foreign currency orders. Label places earn very similar interest rates to discounts membership and they are heavily linked with the cash price.

That it savings account have no month-to-month fix with no minimum deposit demands. Your own lender https://vogueplay.com/ca/queen-play-casino-review/ establishes the new restriction for the quantity of distributions your can make from the higher-give bank account monthly. You to amount would be half a dozen times a month, as the that used to be the fresh federal restriction.

- And since of several People in america reduce saved than they must, the fee part of yield facilitate.

- There has to be home elevators just how your unique merchant protects very early terminations, however you want to make an effort to find out before you take out a term deposit.

- You’ll you desire at the very least $ten million in the investable possessions to be a personal Riches Administration buyer otherwise $1 million in order to $ten million to participate UBS prominent money management.

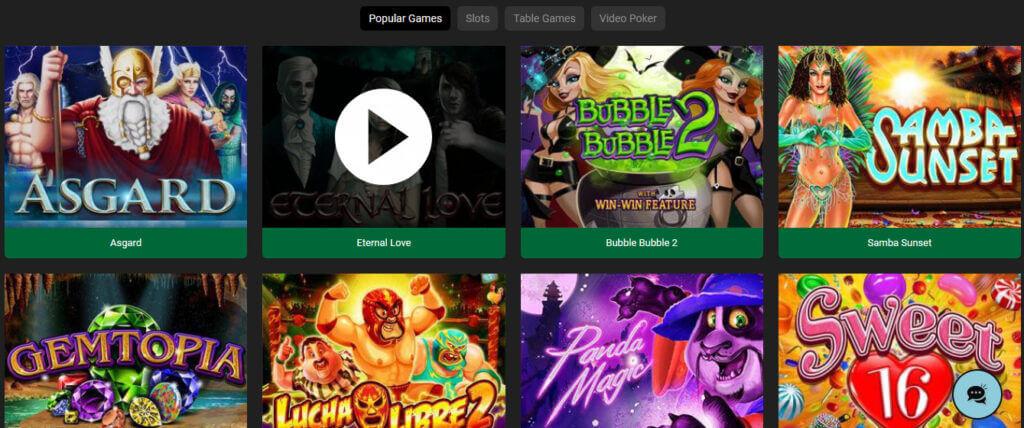

It means professionals now have much more possibilities when it comes to determine what to enjoy. DingDingDing is probably a preferred, as a result of the smooth graphics and you can excellent customer service team. Each day rewards allow it to be simple to maintain the fresh video game launches also. This is simply one of many social gambling establishment software you could potentially obtain in order to play on the newest wade.

College loans try payment fund in the U.S. government otherwise individual loan providers that are always purchase academic expenditures. In the one out of four family (21.7%) have a great college loans, plus the median balance is $twenty four,five hundred. Home financing is a protected mortgage one to’s familiar with pick domestic otherwise industrial possessions.

Wisconsin Dinner Worth the Push, Centered on Cooking Advantages

Instead, if you want to open a free account individually having a professional lender, it’s also wise to look at many others with this checklist. For example, Valley Lender is providing the higher APY outside of the Raisin-associated financial institutions. CIT Financial is even lead and you may relatively competitive with the desire price. Find Financial is actually a highly strong brand name that have solid financials.

Earn a plus adjustable price to the first 4 months to the balance around $250,000, with a high constant rates thereafter. No account staying charge or minute harmony, which have interest paid back monthly.Intro rates for new consumers just. We wouldn’t worry about the safety – they’ve been around for extended having a great profile.

Do you know the advantages of bank accounts on the rich?

Coupon codes will come of member websites for example content, recommendation requirements of family members, plus social media giveaways. They offer a new band of numbers and characters you might enter in inside checkout procedure when selecting coins. Put it inside the just before your own credit information to see your own write off and in case they’s become applied. Which are the most widely used redemption methods of the best personal gambling enterprises for 2025? It is very important ensure that you can find several assistance choices offered, including email address and live talk.

Better Banking companies No Atm Costs to own 2025

The goal is to outline out a space out of possibility of construction with the issues rather than to incorporate an enthusiastic exhaustive number of all of the days. Automobile financing is secure cost financing for both the new and you will made use of autos, and’lso are constantly removed for three so you can seven decades. On the one in around three families (34.7%) features car loan financial obligation, having an average amount of $15,000. Couples having people have the higher median loan amount ($18,000), when you are single those with college students feel the lowest average loan amount ($9,800).